For the last two years, the Russian economy has been going through a difficult period, which many politicians and experts associate with the effect of the sanctions imposed by Western countries and international organizations. The first sanctions were imposed in March 2014, and although the main unit of sanctions was already initiated in March-July 2014, the number of sanctions still continues to grow. Thus, the Russian economy has been under the pressure of sanctions since the second half of 2014, and it is exactly this period that should be analyzed in the context of the sanctions’ impact on the development of the Russian economy.

The situation in this period was characterized by a decline in most of the key macroeconomic indicators. So, in 2014 GDP growth amounted to symbolic 0.7%, and slowed sharply in the second half of 2014, in 2015 a significant economic decline was recorded – 3.7%, and in the first half of 2016 decline in GDP amounted to 0.9% (hereinafter – the data of the Federal state statistics service (Rosstat), unless otherwise indicated).

Not only GDP showed a negative trend during this period, but also other key economic indicators. In particular, in 2015, manufacturing industry showed a significant decline (-3.6%) mainly because of the reduction in volumes of processing industry by 5.4%. Furthermore, the dynamics of investment in capital stock were also negative and fell by 1.5% in 2014 and by 8.4% in 2015. The deterioration of macroeconomic indicators was also accompanied by a decline in social indicators. The first decrease in disposable income of the population (by 0.7%) was recorded in 2014, which only intensified by the end of 2015 (declined by 4.3%), and continues to do so in 2016.

Thus, the formal relationship between the sanctions being imposed against Russia and a sharp slowdown in its economy does exist. Regarding this relationship, there are a number of statements from a wide range of politicians of countries that have initiated the sanctions, and a number of public figures that connect the negative dynamics of the Russian economy with the sanctions. However, politically unbiased experts, western included, note that the sanctions’ role in the economic problems of Russia is insignificant, and that the decline of the Russian economy is not linked to the sanctions, but linked to the fall in prices of oil and other commodities.

In fact, the only sanction that was negative to Russia was the prevention of access to Western financial markets, which created significant problems for borrowers, who after the sanctions became deprived of operational capabilities to refinance payments on foreign currency debts. The same factor became the first cause for the devaluation of the ruble, which began in mid-2014. However, the Russian economy coped with it without significant consequences, and moreover, because of limited borrowing capabilities, the foreign debt of Russia significantly decreased – from $729 billion at the beginning of 2014 to $520 billion in the first quarter of 2016 (according to the Bank of Russia). This means that the financial sanctions of the West has eventually led to the recovery of the Russian financial system and to a significant reduction in the debt burden of the Russian economy. Reduction in the foreign debt also means, among other things, a decrease in the future potential of economic destabilization due to exchange rate changes, and an increase of its overall resistance to external shocks.

Otherwise, the sanction factor did not play a significant role in the Russian economy and its impact on the macroeconomic level is insignificant to the point that it is not quantifiable, while within the statistical error. The main cause of the economic problems of Russia was the fall in commodity prices, in particular – oil and gas, and other raw materials that are exported from the country.

It is exactly this factor that delivered the main blow to the Russian economy and other resource-based economies as well. As a result of the decline in world prices, exports from Russia declined by $200 billion – from $592 billion in 2013 to $393 billion in 2015. The fall in oil prices that began in the second half of 2014 and continued in 2015 caused all of the major negative factors that influenced the Russian economy the most – reduction in foreign currency earnings, low corporate earnings and, as a consequence – low tax deductions, depreciation of the ruble, capital outflow, reduced investment, optimization of budget expenditures, decline in revenues and standard of living.

Along with exports, the volume of imports also declined – from $470 billion in 2013 to $282 billion in 2015, which was largely due to the two-time devaluation of the ruble and a strong reduction in people’s purchasing power and demand for imported goods. Foreign direct investment inflow in Russia has also declined, although this reduction was not too significant.

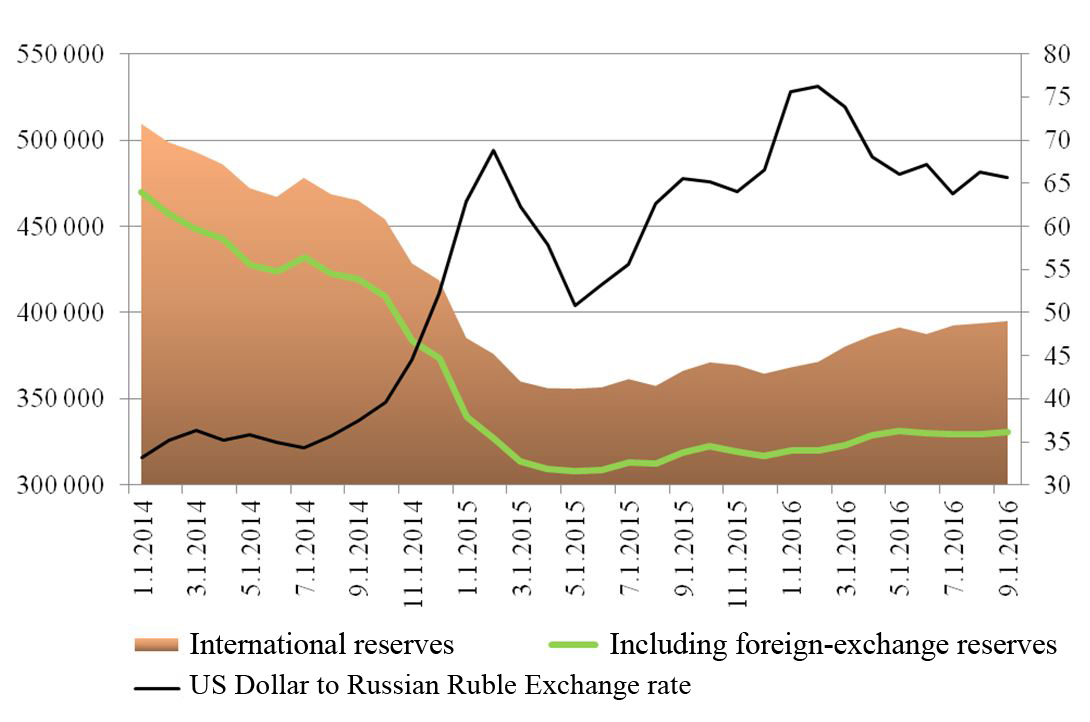

The most notable manifestation of the crisis in the Russian economy is the situation in the currency market. The ruble was falling from June 2014 to January 2016 when it was at its minimum – 86 rubles for 1 USD. In this case two phases of interfering in the process of the ruble’s fall by the central bank can be identified. During the first one, which lasted from July 2014 to June 2015, the Bank of Russia was trying to hold back the fall with currency interventions, which led to a strong reduction of reserves – from $510 billion to $356 billion of its total volume (Figure 1).

Figure 1. Comparison dynamics of the dollar against the ruble and the main parameters of Russia’s international reserves (in million US dollars) (Calculated on the basis of the following sources: [1], [2]).

In the summer of 2015, the practice was curtailed and the ruble became free float. First, it has led to a new round of dollar rise to its historic highs, but during 2016 the ruble mainly strengthened – primarily under the influence of the oil prices, which rose this year. At the same time, during this period, the level of reserves started to gradually recover, increasing by about $50 billion.

The relationship of the ruble and the state reserves with oil prices also indicates that the problems of the Russian economy of 2014-2016 were not caused by Western sanctions, but by the unfavorable situation in the commodity markets.

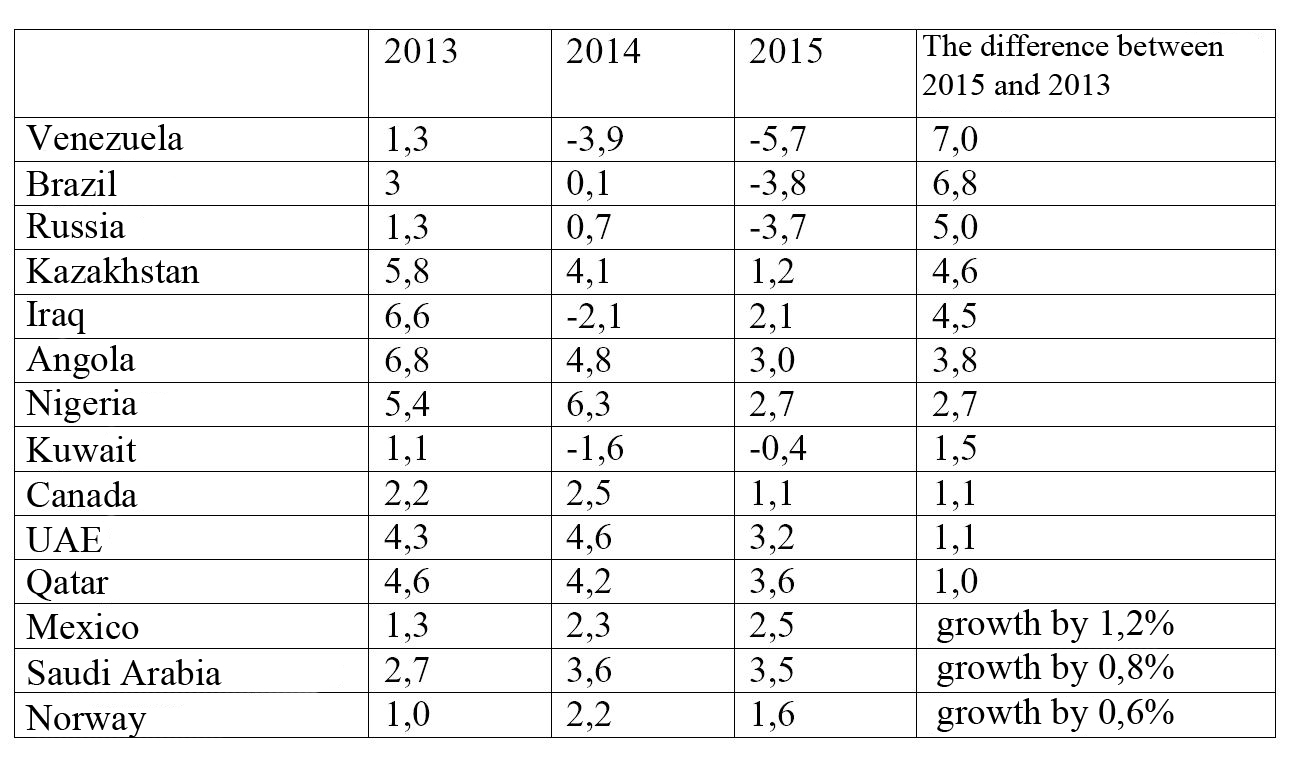

This conclusion is also confirmed by the fact that Russia is not the only oil exporter country that has experienced economic problems in recent years. Most of the countries that are in the top twenty in terms of oil production, and where oil revenues are playing an important role, have also experienced the economic shocks and a sharp slowdown in economic growth (Table. 1).

Table 1. Changes in GDP during 2013-2015 in the countries that are in the top twenty in terms of oil production, %. Source: [3].

In terms of the negative impact of the drop in oil prices on the economy, which can be estimated by the difference in growth rates between 2013 and 2015, Russia is not a leader and is in proximity to such countries as Venezuela, Brazil, Kazakhstan, Iraq, Angola and Nigeria, which were not subjected to additional pressure in the form of sanctions. Comparison of the growth of Russian indices with analogues of other oil-producing economies also shows that it was the price of oil, rather than Western sanctions that have caused economic problems in recent years.

This clarification is important in terms of predicting future development of the Russian economy. By considering oil market conditions as the main reasons for the slowdown, it is possible to more accurately assess the potential of further dynamics, whereas the version of sanctions as the main factor of economic problems provides incorrect guidance for forecasting.

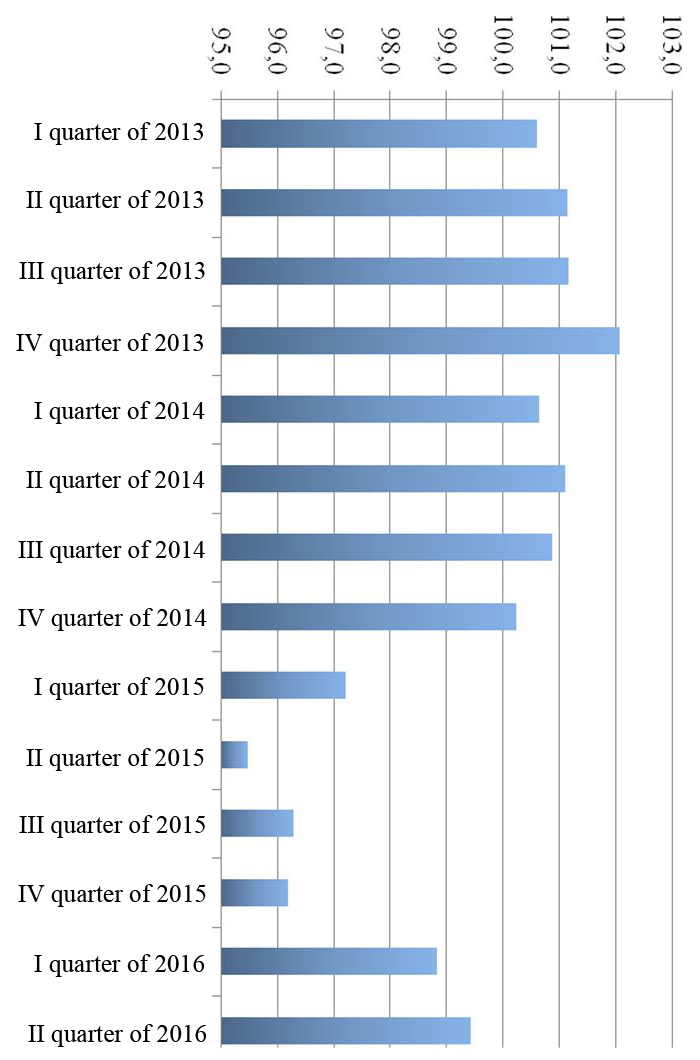

The slowdown of economic growth that transformed into a recession and other problems of the Russian economy discussed above currently has almost exhausted its negative resource. Thus, in the first half of the year, the decline in GDP amounted to insignificant 0.9% compared 3.7% decline in the first half of 2015. Even more clearly the stop of negative macroeconomic trends is noticeable in the quarterly data (Figure 2) – the extent of GDP decline has been decreasing from the third quarter of 2015 and become very insignificant in 2016.

Figure 2. Index of physical volume of Russian GDP, % of the corresponding quarter of last year. Source: [4].

Additionally, this year the rise was mainly in industrial production, and the mining industry experienced growth in each of the eight months (compared to the same period last year), and in general for the first 8 months of the year, the industry increased its production by 0.4%.

Nonetheless, despite the halt of negative trends, the situation in the Russian economy remains tense, as manifested in some of its key areas.

First of all, there is a difficult situation with the budget process. There has been a loss of significant volumes of budget revenues due to the fall in oil prices. Thus, income from export duties on crude oil dropped to 1.1% of GDP in January-July this year from nearly 2% of the last year and 4% of GDP of 2011. The reduction in revenues has led to a sharp growth of deficit in the federal budget – if in 2013 its deficit amounted to only 0.5% of GDP, by the present time (January-July 2016), it rose to 3.3% of GDP.

The difficulties with the implementation of budgetary obligations in the environment of income reductions have led to the extensive use of the Reserve Fund, which began to decline rapidly. Only in the first half of 2016 more than $12 billion has been spent from the Reserve Fund, and according to current forecasts, the fund balance will be exhausted by 2017. On August 5, Deputy Finance Minister M. Oreshkin said that the spending of the Reserve Fund of Russia in 2016 could reach 3 trillion rubles with its current volume of 2.56 trillion.

Exhaustion of the Reserve Fund, from which part of the budget deficit is financed, considering the growth of that deficit, forces to seek other sources of income. Among these sources are privatization (in the first place, of “Rosneft” company), dividends on the state share holdings, and certain maneuvers with the pension payments and the prospects of tax increase. Furthermore, Russia despite the sanctions can borrow on international financial markets, and with a small percentage – the most recent of such borrowings was implemented by the placement of Eurobonds in the amount of $1.25 billion on 22 September with the yield less than 4% per annum.

Tense situation with the budget and its consequences creates a certain negative background, which negatively effects the investment programs of state-owned companies (and investment activity in general), and also increases social tensions.

At the same time the scale of these problems should not be overestimated because the social sphere as a whole and main socially significant indicators (inflation and unemployment) remained stable, and their deterioration on the macro-level was insignificant. Thus, the unemployment rate remains on nearly the same level as in the pre-crisis period of 2012-2013 (5.6% vs. 5.5%), the average nominal wage is gradually increasing, and inflation rate remains moderate (3.9% in the first 8 months of 2016).

In summary, the following conclusions can be drawn about the results of development of the Russian economy and the current stage of its activities after the introduction of sanctions:

– sanctions did not have any significant effect on the Russian economy, but the drop in oil prices has led to significant problems for foreign trade lines, budget, financial stability and social protection of the population;

– the most affected spheres of the Russian economy during 2014-2016 were finance (the devaluation of the ruble, a sharp reduction in reserves, the destabilization of the banking sector), the state budget process, the manufacturing industry (due to the fall in purchasing power), and investments;

– the peak of the crisis in the Russian economy has already passed, and recovery begins, which is noticeable on the dynamics of GDP growth and industrial production, as well as on some indicators of living standards;

– the situation remains tense in some aspects (the budget process, the status of the Reserve Fund) and continues to strongly depend on the situation in world commodity markets.

Forecast on the development of the Russian economy in 2016-2017

Currently, assessment of prospects of the Russian economy for 2016-2017 varies quite widely, including the forecasts of various government departments. For example, the Bank of Russia in its report on monetary and lending policy assesses the decline of GDP in 2016 to 0.3 – 0.7%, in the forecast of the Ministry of Economic Development the decline is expected to be 0.6%. In 2017 a moderate economic growth is expected – the Central Bank forecasts growth of 1%, while the Ministry of Economic Development – 0.6%.

Nongovernmental forecasts also suggest a reduction of recession in the second half of the year and a slight growth in 2017. If the forecasts for 2016 are roughly in the same range as that of the government, and suggest the decline of 0.5 – 0.7%, the expectations for the next year are more optimistic and range at around 1.5%.

Positive expectations for the resumption of economic growth at the moment are linked to the third quarter of 2016 – according to the data of the Ministry of Economic Development the recessions stopped in the second quarter, and in the third quarter a number of major analytical agencies forecast a slight growth of GDP. Thus, the recession, which has lasted for 6 consecutive quarters in Russia, from the first quarter of 2015 to the second quarter of 2016, will stop, although the final GDP growth for the year will still be negative.

In our opinion, these forecasts are well founded. There are several prerequisites for the resumption of economic growth in Russia – the active role of the state and the ongoing anti-crisis policy; rapid import substitution, which is also stimulated by the sanctions war of the West and Russia, resulting in the Russian market forming a niche to be filled with its own producers; stabilization of the financial sector, including the reduction of interest rates and the resumption of lending activity in most of the segments; improvement of the situation in the world commodity markets.

The latter factor can be a decisive turning point in the crisis tendencies. Since it is the drop in oil prices that caused main problems of the Russian economy, the recovery of the oil prices will cause a similar positive effect. In this case it is not the scale of growth that is important, but the very fact of the growth, which will be enough to bring macro-economic indicators to positive values. It is not necessary for oil price growth to be strong, it will be enough if it is higher than the value of the previous period, this will allow macroeconomic indicators that are linked to oil to increase in relation to the past periods.

For such a development in the oil market all prerequisites are present. Currently, the main factor of the oil price is the monetary policy of the central banks of developed countries, especially the US Federal Reserve. Given the fact that the Fed has actually declined the last year’s rhetoric to raise rates, and the expected stability of the rates to at least until the end of 2016, as well as the probability of a change of course and the transition of the Fed to another mitigation (which is very likely considering the slowdown of economic growth), the prospects of the oil market currently seem to be positive.

There is also a technical aspect of the movement of oil prices, caused not by fundamental factors of oil production rates, or even monetary liquidity factors in the market, but by the mood and assumptions of investors on the “correctness” of certain price levels. In accordance with these factors, current prices are technically in the corridor of $41.5 – $52.5 for “Brent” oil. In case the price leaves the corridor upward and fixes above the level of $52 – $53, it is very likely that the price will move further upward to the level of approximately $65. In our opinion, this movement is quite possible considering some of the Fed statements on the need for mitigation of the monetary policy or clear announcements of the Fed’s rejection of the tightening in the near future.

Thus, in the short term, the situation in the oil market seems favorable for the Russian economy, there is a high probability of further increase in oil prices and consequent positive effect for all commodity economies. This effect will occur in the same fields that were negatively affected before, but with the opposite sign – there will be a growth in export and earnings in foreign currency, the strengthening of the ruble exchange rate, a gradual increase in the volume of industrial production, GDP, filling of the revenue side of the budget, and recovery of the Reserve Fund and the National Wealth Fund.

If our forecast scenario comes true, and oil prices rise to around $65 by the end of this year, in the second half of the year, the Russian economy will show growth, the potential of which could be measured by a value of 0.5 – 1%. This assessment is based on the fact that the average oil price in the second half of 2015 was $47 for “Brent” oil, and with the oil price around $65 by the end of the year, the average price of the second half of 2016 will amount to $50 – $55, which is by 7-15% higher than the price in the same period of 2015.

The relationship between oil prices and Russia’s GDP in recent years was expressed by a ratio of about 10 to 1 – drop in oil prices in 2014-2015 by 50% led to a decrease of 5% in GDP. Therefore, the increase in oil prices by 10% may lead to Russia’s economic growth by 1%.

The prospects for the oil market in 2017 are currently uncertain and, in our opinion, the market will either moderately grow (by 20-30%), or stabilize with the average annual price of about $50, meaning there will be no significant growth compared to 2016. In each of these scenarios, the Russian economy will grow.

If oil prices are stable, the growth rates will be moderate, approximately at 1%, but there will still be growth due to other sources, primarily because of the increase in domestic demand caused by the resumption of banking credit activity and the continuation of the government programs. And in case of the scenario of a significant growth in oil prices, an increase in Russian GDP may amount to more than 2%.

These two scenarios also assume different impacts of economic growth on other key areas of the Russian economy. In the first scenario with the insufficient increase in oil prices and symbolic increase in GDP, many of the current problems, however weakened, will still remain – a large budget deficit, exhaustion of the Reserve Fund, and subdued investment activity. While in the scenario with a significant increase in oil prices (by more than 20%), almost all of the problems will be completely or mainly resolved.

List of references:

- Международные резервы Российской Федерации. Банк России – официальный интернет-ресурс. URL: http://www.cbr.ru/hd_base/default.aspx?Prtid=mrrf_m (дата обращения: 21.09.2016).

- USDRUB_TOM. РБКQuote. URL: http://quote.rbc.ru/exchanges/demo/selt.0/USD000UTSTOM/intraday?show=intra3 (дата обращения: 21.09.2016).

- GDP Growth. World Development Indicators// World DataBank. The World Bank website. URL: http://databank.worldbank.org/data/reports.aspx?Code=NY.GDP.MKTP.CD&id=af3ce82b&report_name=Popular_indicators&populartype=series&ispopular=y# (дата обращения: 20.09.2016).

- Индексы физического объема валового внутреннего продукта // Валовой внутренний продукт. Квартальные данные// Национальные счета. Федеральная служба государственной статистики. Официальный интернет-ресурс. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/accounts/# (дата обращения: 19.09.2016).